Dow futures are indicating a downward trend

During the evening trading session on Thursday, U.S. stock futures exhibited a varied performance, following a predominantly positive session for major benchmark averages. This optimistic sentiment was spurred by GDP data that outstripped expectations, thereby bolstering investor confidence. Furthermore, banks saw an upswing after the Federal Reserve announced that all 23 institutions featured in its annual stress test were sufficiently capitalized to endure a severe recession.

By 18:45 ET (22:45 GMT), Dow Jones futures were showing signs of a downward shift, marking a slight dip of 0.1%. In contrast, S&P 500 futures and Nasdaq 100 futures remained stable, indicating no significant changes in these indices’ projected opening levels.

In the wake of extended trading hours, shares of Nike (NYSE:NKE) experienced a 4.3% drop. This decline was triggered by the company’s Q4 earnings per share (EPS) of $0.66, which fell $0.02 short of the analyst estimate of $0.68. Despite this, the company’s revenue reached $12.8 billion, surpassing the anticipated figure of $12.58 billion.

Conversely, Accolade (NASDAQ:ACCD) witnessed a notable surge of 15.4% during after-hours trading. This increase followed their Q1 report, which revealed losses of $0.52 per share, outperforming the expected losses of $0.62 per share. The company also reported revenue of $93.2 million, exceeding the forecasted figure of $90.27 million.

As we look forward to Friday’s trading session, market participants will be keenly observing new data on the PCE price index, personal income and spending, as well as the Michigan consumer sentiment and expectation surveys. These indicators will offer crucial insights into the health of the U.S. economy and could steer the direction of the stock market.

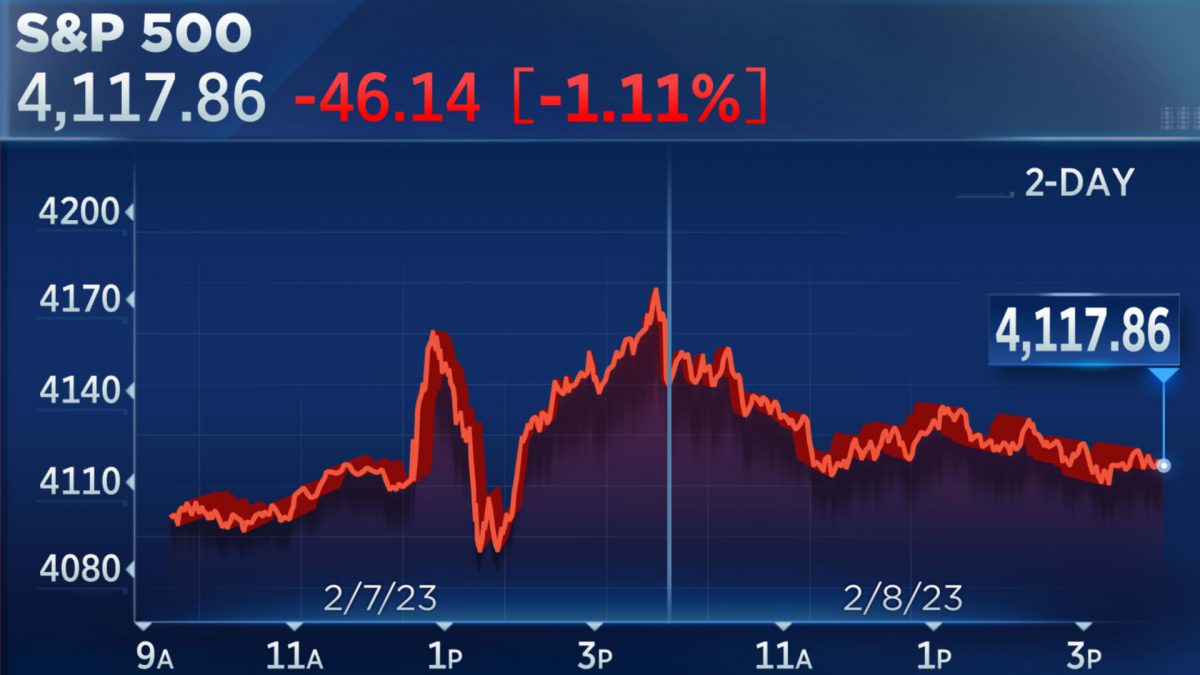

During regular trading on Thursday, the Dow Jones Industrial Average rose by 269.8 points or 0.8%, closing at 34,122.4. Similarly, the S&P 500 climbed by 19.6 points or 0.5% to 4,396.4. However, the Nasdaq Composite wrapped up the day virtually unchanged at 13,591.3.

From a fixed income standpoint, the yield on the United States 10-Year Treasury note was pegged at 3.848%. Given that bond yields move inversely to prices, this level of yield suggests that investors are bracing for a rise in interest rates, which could exert further pressure on the stock market.

.webp)