Day trading often looks thrilling from the outside. Fast charts, quick decisions, and the idea of closing trades the same day sound exciting. For many newcomers, the forex market adds another layer of attraction because it stays active almost all the time. Prices move constantly, opportunities appear frequently, and access feels easy. However, without understanding how things actually work, beginners tend to lose money faster than they expect. That is why learning day trading forex for beginners properly matters far more than placing the first trade quickly.

Many new traders believe success comes from speed. Yet, real progress comes from structure, patience, and discipline. Let’s get one thing straight—forex day trading isn’t about nailing perfect predictions. It’s about managing your risk, reading how prices move, and keeping your emotions in check. This guide walks you through the process step by step, so you actually know what you’re doing before you throw your money into the market.

We’ll kick things off with the basics: what day trading in forex really means. After that, I’ll walk you through some core strategies, the risks involved, the mental game, and finally, a realistic way to learn the ropes.

What’s Day Trading in Forex?

Day trading in forex means you open and close your trades on the same day—nothing stays open overnight. You avoid those late-night surprises when the market reopens and prices jump for reasons you couldn’t see coming.

The goal isn’t to chase huge swings. Instead, you’re looking to grab smaller moves that happen during the busiest hours. Sure, those price bumps might seem small at first, but if you stick with it and manage your trades well, they add up.

Most forex day traders stick with big currency pairs like EUR/USD or GBP/USD. Why? They’re traded a tonne, meaning in huge volumes, so it’s easier to get in and out without big price gaps. During day trading forex for beginners, the spreads stay tight, and your trades usually go through smoothly. But, the flip side—more trading means prices can move fast, so you get more chances to profit, but the risks ramp up too.

Now that the core idea is clear, the next logical question arises—why does forex day trading attract beginners so strongly?

Why Choose Day Trading Forex for Beginners

Forex feels accessible. It allows small trade sizes, flexible timing, and easy entry through online platforms. Additionally, beginners are not restricted by stock market hours, which makes forex trading feel more convenient.

Furthermore, because trades close on the same day, overnight risk with higher volatility is avoided. That sounds reassuring. But risk doesn’t go away; it just moves into shorter time periods. Price moves faster, decisions need to be sharper, and mistakes become costly if unmanaged.

That is why day trading forex for beginners should never start with speed. Instead, it should

begin with understanding how the forex market actually functions and that is exactly where we go next.

How the Forex Market Works (Without the Jargon)

Now that we are discussing day trading forex for beginners, you should know that in foreign exchange, two currencies are always involved. In this, a currency is purchased, and another is sold simultaneously. Prices are influenced by supply and demand, interest rates, economic data — such as changes in gross domestic product or unemployment numbers — political developments, and even general sentiment about the market.

And traders around the world react differently to the same news. Day traders try to take advantage of the intraday volatility created by this reaction.

In foreign exchange day trading, market timing also matters, and it is a general consensus that the London and New York sessions are usually the most active. Therefore, beginners often focus on these periods. However, higher activity means faster movement, and quicker movement demands stronger control.

Let’s get real—before you even think about strategies, you need to nail down a few basics. These aren’t just nice-to-knows; they’re the backbone of every single trading move you make.

Day Trading Forex for Beginners: What You Need to Know

When we talk about day trading forex for beginners, don’t jump into trades blind. Here’s what you really need to get comfortable with first:

- Pips: This is the tiniest movement in price.

- Lot size: How big your trade actually is.

- Spread: The gap between what you buy and sell for.

- Leverage: Borrowing money to boost your buying power.

Leverage is a double-edged sword. Sure, it can pump up your gains, but it’ll do the same to your losses—fast. Start small with leverage. And remember, protecting your capital always beats chasing quick profits.

Once you’ve got these basics down, you’re ready to start thinking about how to actually trade during the day.

Day Trading Forex for Beginners: Top Strategies

Let’s be honest—complicated systems just trip up most beginners. Keep it simple. The strategies for day trading forex for beginners below give you a clear view of how prices move, without drowning you in technical noise.

-

Price Action Trading

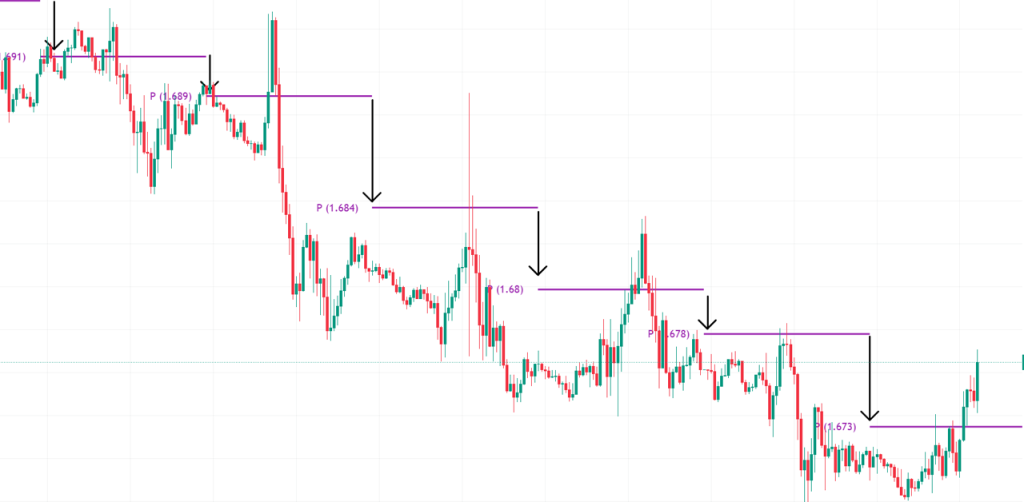

Forget a million indicators. Price action is all about reading the chart itself. You’ll watch things like support and resistance and spot candlestick patterns. This way, you learn how the market really moves—not just what some indicator tells you.

-

Trend-Following

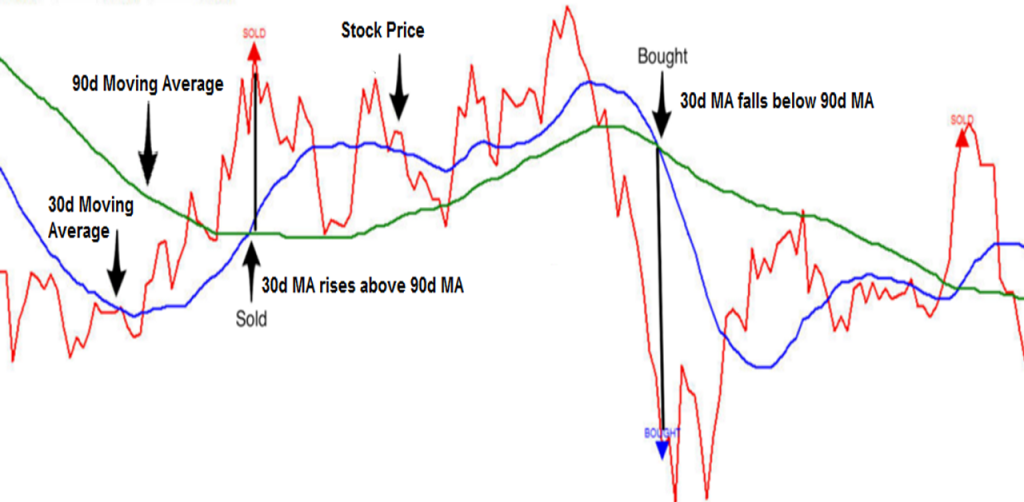

Stick with the flow. Trade in the same direction as the current trend. Wait for the price to pull back before jumping in. It takes patience, and some days, the market just won’t give you a clear trend. That’s normal.

-

Breakout Trading

Breakout traders step in when the price pushes beyond important levels. This can be exciting—you can catch some big moves. But false breakouts happen a lot, so you need to manage your risk tightly.

-

Swing Trading

Swing trading isn’t technically day trading, but a lot of beginners try it. Trades last a few days, aiming for those mid-term price swings. It’s slower paced, which can help new traders handle the emotional ups and downs.

-

Scalping

With scalping, you’re after tiny moves over very short periods. It’s tempting, but it demands laser focus and real discipline. If you’re new, approach scalping with extra caution.

-

Mean Reversion

Here, you’re betting that prices will snap back to their average after making extreme moves. Mean reversion trading assumes that an asset’s price, after fairly extreme moves (high or low), will revert to its historical mean, as large deviations are mostly temporary and unsustainable. Traders search for overbought (high-priced) and oversold (low-priced) assets, taking advantage of low prices driven by news events or overall market weakness. Examples include trading breakouts in the stock market and making money whether a security is trading with higher or lower volatility – also using tools like Bollinger Bands, RSI, and MAs when you get in and out of trades. It is primarily effective in range-bound markets, where prices oscillate around a central point.

No matter which strategy catches your eye, always practice on a demo account first. If you rush into live trading, you’ll probably make mistakes you could have avoided.

And once you’ve learned these approaches for day trading forex for beginners, never forget that it is what really matters — risk management. That’s the thing that makes you a pro in currency trading. Risk management is not optional. It is the foundation of survival in day trading forex for beginners. Without it, even strong strategies fail.

Key principles include:

- Risking only a small portion per trade

- Always using stop-loss orders

- Avoiding revenge trading

- Accepting losses without emotional reaction

Moreover, beginners should aim for consistency, not dramatic wins. Protecting capital allows learning to continue. Losing it ends the journey early.

Yet, even with good risk control, emotions can still interfere. That brings us to psychology.

Trading Psychology: The Silent Decider

Charts do not cause most losses—emotions do. Fear after losses, greed after wins, and impatience during slow markets push beginners into poor decisions.

Successful traders remain neutral emotionally during trading. They follow rules even when emotions suggest otherwise. In foreign exchange day trading, mindset often decides long-term results more than strategy selection.

Additionally, reviewing trades and taking breaks helps reset emotional balance. Learning improves when reflection replaces reaction.

Day Trading Forex For Beginners: Common Beginner Mistakes to Avoid

Many beginners fall into similar traps:

- Overtrading out of boredom

- Ignoring stop-loss levels

- Using too many indicators

- Expecting fast, easy money

Avoiding these mistakes does not guarantee success, but it significantly improves survival. Moreover, fewer mistakes mean clearer learning.

To support learning further, beginners should also use the right tools—nothing more, nothing less.

Day Trading Forex for Beginners: Tools Beginners Actually Need

Beginners do not need advanced software. Simple charts, a few indicators, and an economic calendar are enough. Demo accounts, in particular, allow practice without financial pressure.

Eventually, traders may explore advanced tools or automation. However, mastering the basics always comes first. With tools and structure in place, the final piece is understanding how learning itself should be approached.

Conclusion

It is considered that intraday currency trading is not a way to easy riches. However, it’s exhausting. rigid, and psychologically demanding on top of everything else. But for beginners who take the time to slow down, engage with the process, and learn before they earn, flipping can be more about mastering a craft than taking a chance.

In this piece, we went over the essentials of day trading forex for beginners – how various tips work in practice and why risk management works hand in hand with psychological control. Moreover, no trader can be successful unless their broker platform is capable, and here at Xtreme Markets, we offer excellent options with low spreads, quality support, and low fees.